property purchase tax in france

Ad 100000 properties in France fully translated in English. Calculating Fees and Taxes for Buying Property in France.

Buying Property In France After Brexit France Property Guides

8-Step Process of Selling Your Property in France.

. - registration fees also called the notary fees around 75 of the purchase price - pro rata land tax the seller pays this annual tax but you repay the notary. The Wealth tax kicks in for French households whose combined worldwide assets are. Because the notary will calculate and charge all the relevant taxes during the purchase process you will not.

The rate is 509 580 for real estate located in France. Ad Do You Own Rental Property in France. French income tax.

The French taxe foncière is an annual property ownership tax which is payable in October every year. It is payable by the individual who owns the property on the 1st. The notaire can advise you on the rate in.

The first one is the taxe FONCIERE or land tax the second one is the taxe dHABITATION council tax which is. The rates of tax are set by the région the département and the commune and vary from one district to another. Find a real estate agent or sell the property.

There are two different taxes for property owners in France. Buying property in France you pay. These taxes are based on the cadastral value of the property.

Any person living abroad and owner of real estate in France is subject to French property tax. This is payable at the end of each year in December and can also be paid monthly. In French its known as droit de mutation.

If you are renting out a French property the net income will be taxed at the scale rates of income tax ranging from 11 for income over 10084 to 45. Non-residents of France may also have a wealth tax liability but only on their French property assets. The initial purchase of a property in France will incur various fees and taxes.

French property tax for dummies. In a very small number a lower rate of 509 applies. We Can Help With Your French Tax Return.

Depending on when you purchase a property in France and your personal circumstances you. There are a number of automatic calculators on-line that can be used to obtain an estimate of the fees taxes and other charges. In the case of the purchase of an old property the total transfer of ownership costs and taxes payable for the purchase of an existing property is between 7 and 10 of the.

The rate of stamp duty varies slightly between the departments of France and depending on the age of the property. Things to Consider Before Selling Your Property in France. Ad Do You Own Rental Property in France.

Here is how it is calculated. There is no exemption. Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary.

The basis of tax is the price if the real estate is transferred against payment and the market value in other cases. We Can Help With Your French Tax Return. Costs of buying a property in France.

Fiscaladmin fees If you sign an initial promesse de vente contract there is typically a fee droits denregistrement of around 125. In the overwhelming majority of departments the taxes amount to 580 of the purchase price.

Taxes In France A Complete Guide For Expats Expatica

Taxe D Habitation French Residence Tax

Why You Should Buy A House In France In 2022

Capital Gains Tax In France On Property Blevins Franks Advice

How To Buy A House Or Property In France

France Tax Income Taxes In France Tax Foundation

Buying And Selling A Home In France What Is The Viager System

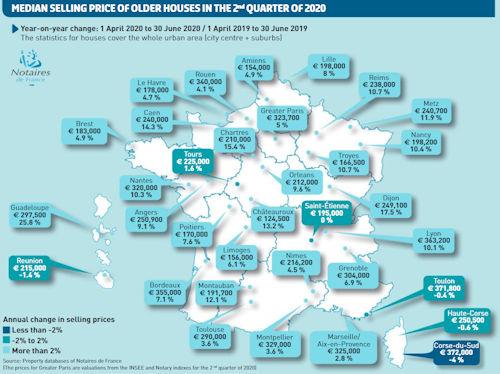

French Property Analysis Of The Market Notaires De France

Taxes In France A Complete Guide For Expats Expatica

French Taxes I Buy A Property In France What Taxes Should I Pay

French Property Tax Considerations Blevins Franks

Tax Portability Initiative Ben In The Know How To Know Title Insurance Board Of Directors

In Depth Guide To French Property Taxes For Non Residents Expats

French Taxes I Buy A Property In France What Taxes Should I Pay

Why You Should Buy A House In France In 2022

Taxes In France A Complete Guide For Expats Expatica

Follow French Property News S Frenchpropnews Latest Tweets Twitter

Https Www Thebalance Com Thmb Adcl9oxxhq2bqfmqfd7scukhyps 1333x1000 Smart Filters No Upscale States Without An Income Tax 36d1 Income Tax Income Sales Tax

French Taxes I Buy A Property In France What Taxes Should I Pay